Nigeria’s cost of living continued to strain households last December, even as national inflation showed signs of easing, according to the latest Consumer Price Index (CPI) report from the National Bureau of Statistics (NBS). The figures reveal that price pressures remain uneven across the country’s 36 states and the Federal Capital Territory, with sharp differences in how fast costs are rising from one region to another.

In December 2025, headline inflation in Nigeria fell significantly to 15.15% year-on-year, a marked decline from the double-digit increases seen throughout much of 2024 and earlier months. Food prices — a key driver of living costs — also slowed, with the food inflation rate dipping to 10.84% year-on-year. Analysts linked this moderation to lower prices for staples including tomatoes, garri, eggs, grains, vegetables, beans, and onions.

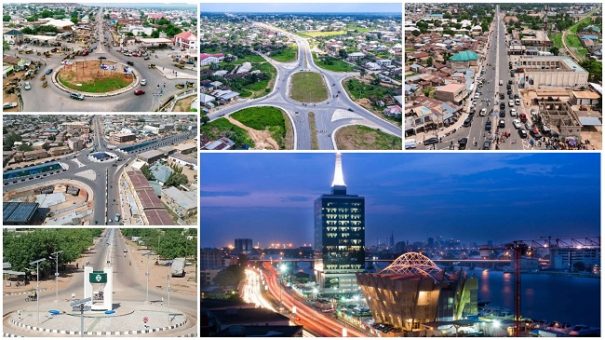

Despite this broader easing, rising prices for rent, transport and essential services continued to push up the cost of living in many states — especially in urban and commercial centres. The NBS data show that non-food prices were significant contributors to the overall inflation burden in these regions.

Below is a breakdown of the top 10 most expensive states to live in Nigeria in December 2025, based on year-on-year all-items inflation rates:

- Abia – 19.0%

- Ogun – 18.8%

- Katsina – 18.7%

- Abuja (FCT) – 18.0%

- Lagos – 17.5%

- Yobe – 17.2%

- Borno – 17.0%

- Enugu – 17.0%

- Ekiti – 16.9%

- Cross River – 16.9%

At the bottom of the list, Cross River and Ekiti recorded inflation of 16.9% each, while Abia State topped the chart with a 19.0% year-on-year increase in the cost of living. Notably, Cross River experienced a significant month-on-month inflation spike of 3.1% in December — one of the fastest increases among all states — driven largely by rising costs in housing, transportation, and services rather than food.

What This Means for Households and Businesses

For business executives, professionals and middle-class families, these figures highlight the persistent regional disparities in Nigeria’s economy. While food prices have shown some relief, core inflation — especially for transport, rent, utilities, and services — remains a key pressure point. Lagos, Nigeria’s commercial capital, remains among the costliest places to live, underscoring the city’s dual role as a thriving economic hub and a high-cost environment for residents.

Similarly, states like Ogun and Abia — long known for their proximity to major economic zones and industrial clusters — are experiencing elevated living costs as demand for housing and services outpaces supply. In northern regions such as Katsina and Yobe, broader macroeconomic pressures are reflected in elevated inflation, even as food costs moderate.

This evolving landscape of regional inflation suggests that businesses planning expansions, relocations, or investments across Nigeria must carefully consider local cost structures — not just national averages — to inform budgeting, pricing strategies, and human resource planning. Workers and families, meanwhile, may increasingly weigh relocation or remote work options as they navigate rising day-to-day expenses.

In summary, the latest CPI data show that while inflation is slowing at the national level, many Nigerian states continue to face high living costs — a reminder of the complex economic challenges facing households and enterprises across the country.

https://palmwinepress.com/business/14-nigerian-banks-meet-cbns-updated-recapitalisation-mandate-cardoso/